Scalping strategies involve making profits on the smallest movements in the markets. To use this strategy successfully, you need to have the best indicator for scalping. We shall tell you about what is the best indicator for scalping in this article.

Please make sure you also read our previous article about Scalping Strategies to maximize your profits!

Moving Average Ribbon

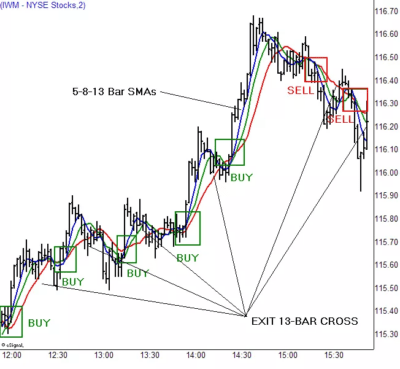

To create an MA ribbon, you must add a 2-minute chart. Use a 5-8-13 SA (simple average) — this should do. The combination is used to identify strong trends, and that is what we need. Once you see a trend, you have to make a decision according to its movement. It is possible to create a short sell or buy order on counter swings. The strategy is very easy to use because once a strong trend appears, the ribbon will be aligned, and it is impossible not to notice that. Also, a word about the prices — they usually are glued to the 5 or 8 SMA.

This free scalping indicator is also capable of showing waning momentum when there are penetrations into the 13-bar moving average. This means that you should expect a potential trend reversal. During such range swings, pay attention to the ribbon as it may flatten, and the prices can crisscross it oftener than usual. You have to wait for a realignment where the ribbons get a specific direction and spread out, getting more space between every line. When there is such a pattern, this is a very accurate scalping indicator to buy or sell, depending on the market situation.

Strength or Weakness Exit

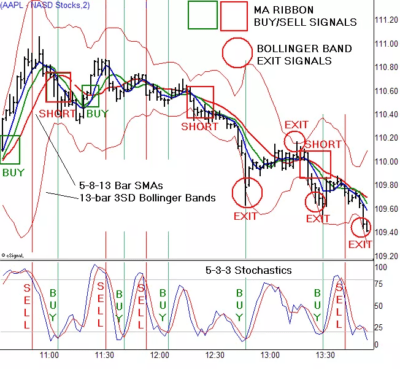

Do you know what the right time to exit is? Do you want to take profits and cut all the losses? The most precise way of doing it is by using a 5-3-3 Stochastics Oscillator, a 13-bar, and three standard deviations Bollinger Band along with ribbons located on two-minute charts. If high-volume markets are used, this is the most profitable option for a trader!

When a Stochastics is over the oversold or under the overbought level, this means that the most profitable ribbon trades appear. If everything goes on the contrary and the scalping indicator does not move into a good position for you after a profitable thrust, exit as fast as possible to prevent losses.

Exiting on the proper time is very important. Watch how the band interacts with the prices. Look for band penetrations. These are the signals that will help you see future trend reversals. Another moment is when a price thrust does not reach a band, but Stochastics rolls over. This is a straight scalping indicator to exit.When you see that you are used to the way everything works and the interaction between technical analysis tools, set the standard deviation up to 4 or lower it till 2 according to the daily changes in volatility. To get an even broader scalping indicator, you can add additional bands to the chart you already have.