Newcomers very often fall into the “fundamental trap,” i.e., they are trying to open positions against the prevailing trend, guided by their stereotypical ideas about the markets and the conclusions of “independent” analysts.

For example, when a bear trend started on gold, many speculators “bought it out,” since they sincerely believed that a shortage of precious metals in the bowels of our planet should provoke an exponential increase in quotations. All this failed.

How does the strategy work?

Anti-trend trading strategies work after strong movements in market prices and open up the opposite direction to these movements. Trading positions opened according to such strategies, use either correction observed after strong trends or, on the contrary, open after corrective movements in the direction of the previous trend correction.

The simplest version of the anti-trend strategy is a trading system in which a buy signal occurs if the price increase relative to the previous maximum exceeds some minimum necessary value (absolute or relative). Another version of the anti-trend system is an oscillatory strategy in which signals are generated when the oscillators reach certain limit values. The difference between this anti-trend strategy and the oscillatory system of following the trend mentioned in the previous paragraph is that in this case, the signals are issued without waiting for the oscillators to reverse.

Varieties and principles of anti-trend systems

There are also Counter trend trading strategy systems in which buy or sell commands are received when prices approach the boundaries of the trend channels: a buy signal occurs when the price approaches the lower boundary of the channel, while a sell signal is generated when the price approaches the upper boundary of the channel.

The principle of determining the boundaries of volatility can be used not only to develop a trend following systems but also to build counter-trend strategies. However, in anti-trend systems, a buy signal does not come after prices break through the upper border of volatility, but when prices approach its lower border. Similarly, a sell signal in systems of this kind comes in when the market approaches the upper limit of the volatility of a traded instrument.

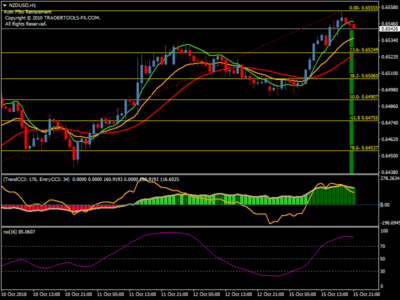

An example of a trading strategy, the purpose of which is to open positions during corrective movements, is a system that uses moving averages to determine a possible correction goal. In this strategy, a signal to open a long position comes when you touch the fast-moving average of the slow-moving average. Similarly, a short position should be opened when touching the bottom of a fast-moving its slower counterpart.