Tickmill Group introduced its proprietary platform in 2014. Ever since it debuted in the market, Tickmill consistently gains market visibility, with the subscription of the company now at 111,000. Said to process more than 263,000 accounts, the brokerage firm impressively breached the standard trade volume and had recorded a month-on-month execution of $123 billion. With its international standing and having been regulated in three jurisdictions, the company then continuously expands in a bid to better its clients’ trading experience.

Regulation and Licensing

Far from the common market-maker status of brokers, Tickmill is known as a client-oriented platform that implements an inclusive trading environment. All of its operations are heavily monitored by the Financial Services Authority of Seychelles, with a license code of SD008. As for its subsidiary in the United Kingdom, the Financial Conduct Authority has been responsible for its overall compliance. Since the regulator greatly exercises security, it then mandates brokerages to provide an insurance of 85,000 euros covered by the Financial Services Compensation Scheme.

The company’s Cyprian leg, which provides service to European clients, is regulated by the Cyprus Securities and Exchange Commission. Having its name filed under several regulatory bodies, clients are then given intensive and lasting protection through the EU’s 5th Anti-Money Laundering Directive, Financial Instruments Directive, and Investors’ Compensation Fund. These are then reinforced by the Tickmill’s segregation of funds and negative balance protection.

Overall, the company’s security stands decently even after clients alleged the broker of stop-loss hunting and market manipulation. While there are various charges filed against Tickmill, the accusations underwent intensive inspection, which in the end was proven untrue and without merit.

Tickmill Account Selection

Tickmill offers three live accounts for its clients. The entry-level Classic account and the Pro account both require a minimum deposit of $100. With this amount, assets may be traded with a commission of $4 per lot. It has a promotional scheme wherein clients need to reach a certain benchmark in order to upgrade to the VIP account.

The VIP account, which requires a maintaining balance of $50,000, has a generous commission of $2. More so, clients who engage in trading index CFDs, oil, and bonds may allocate its fund directly as these assets can be traded are commission-free. What came as the most impressive out of all the conditions in these accounts is the 1:500 leverage ratio. This may be availed through its Seychelles-based subsidiary, with opportunity to utilize swap rates and open Islamic accounts.

Tickmill Salient Features

What sets Tickmill apart from its competitors are the functions integrated within the system. For one, it has a button that allows clients to manage trades and place orders with just one click. This fully automates the interface, allowing users to personalize their trades according to their preferences. Similarly, social trading is also available and is powered by Myfxbook, a third-party service provider that provides access to real-time price movement.

Another feature that may come advantageous is its multi-trader terminal, which then grants users to execute entry-level portfolio management. To date, Tickmill stands as the top providers of institutional services. However, the prioritization of such then leaves no attention for the demands of retail traders.

Education and Research

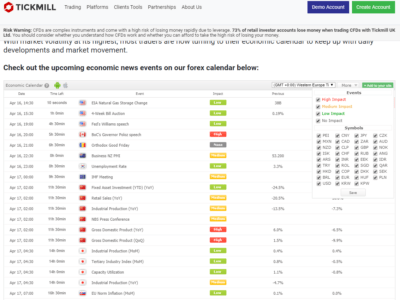

Just like other brokerage firms, Tickmill has its own set of educational and research materials. But what puts Tickmill on a pedestal is the quality of its contents. To say, the brokerage firm employs the expertise of eleven professionals to provide research and market commentaries. Each expert is tasked for a particular topic including market insight, fund analysis, technical analysis, and trade-related articles. Serving as reinforcements are authoritative charts, webinars, and guides to carry out an encompassing learning about the fundamentals of trading.

Customer Support

Tickmill has an impressive selection of communication channels for customer support. For those in need of assistance, they may reach the support team through online ticket, telephone, and email. For immediate queries, they may ask for assistance using the live chat feature located on Tickmill’s official website. True enough, Tickmill has highly-responsive customer support, but the use of such would not be necessary as the company provides a separate section for the most commonly-asked questions.

Conclusion

Considering all the aforementioned features, Tickmill is inarguably decent. Its tight regulation, for one, came compelling for those looking for a secured broker. In addition to this, it offers industry-level trading conditions and a wide selection of assets. These, together with its authoritative learning section and attentive customer support, will surely expand investors’ margin of profitability.